Vancouver Real Estate Hits a 25-Year Low — Here’s What Buyers and Sellers Should Actually Do Next

2025 delivered a headline nobody expected: the lowest number of home sales in the Greater Vancouver area in more than 25 years.At first glance, that sounds like doom-and-gloom. But once you strip away the panic headlines, a much more useful story emerges — one that creates real opportunity for buyers and demands realism from sellers.Let’s break down what’s actually happening, what the experts are saying, and how to move smartly into 2026.A Slow Market… But Not a Free Fall

With sales activity at a generational low and inventory sitting at record levels, many people expected prices to collapse.That didn’t happen.Local Realtor, put it:“You would assume with such extreme market conditions — the slowest market conditions we’ve seen in the last 20 years, plus record-high inventory levels — you would assume prices would be crashing. But they haven’t dropped all that drastically.”That’s the key tension in today’s market:- Sales are down sharply

- Inventory is way up

- Prices are softer — but not collapsing

It’s a confidence market.

Buyers Stepped Back — Not Because of Rates, But Confidence

According to B.C. Real Estate Association and its chief economist Brendon Ogmundson, 2025 started with optimism. Interest rates stabilized. Listings climbed. On paper, conditions improved. But buyers didn’t show up. Why? “We just didn’t have buyers that had the confidence to make transactions work,” Ogmundson explained.Uncertainty — including the overhang of U.S. tariff disputes — kept many buyers frozen. And when buyers hesitate, the entire market slows, no matter how good the fundamentals look.

Why First-Time Buyers Quietly Hold the Advantage

Here’s the part that isn’t getting enough attention:- Investors have largely exited

- Competition is extremely low

- Inventory is abundant

- Prices are down meaningfully from 2022 peaks

- Rates are stable, not rising

Translation:

First-time buyers finally get to shop without bidding wars, emotional pressure, or artificial urgency.

First-time buyers finally get to shop without bidding wars, emotional pressure, or artificial urgency.

The advice from experts is clear:

- Take your time

- Do proper due diligence

- Negotiate confidently

- Don’t rush — there’s no upward price pressure forcing your hand

Sellers: The Market Has Changed — Whether You Like It or Not

This is where reality checks get uncomfortable. Experts are blunt: sellers must adjust expectations if they want to sell in 2025 or early 2026.Ogmundson put it plainly: “Sellers are still anchored to prices that might not be realistic.”And that’s the trap. In this market:

- Testing prices is risky

- Chasing the market down with repeated price cuts is worse

- Overpricing leads to stale listings, not stronger outcomes

The smarter strategy?

- Price correctly from day one

- Be flexible on dates and terms

- Remove friction wherever possible for buyers

Inventory Is Up — Way Up

According to Greater Vancouver Realtors, there were more than 65,000 active listings in 2025, an 8.2% increase over 2024.This matters because:- Buyers have leverage

- Comparable sales matter more than ever

- Presentation, pricing, and flexibility separate sold listings from unsold ones

What Does 2026 Look Like?

Despite the ugly 2025 numbers, economists aren’t pessimistic about the future.Ogmundson expects:

- Pent-up demand to return

- Increased buyer confidence

- A potential boost if trade tensions ease

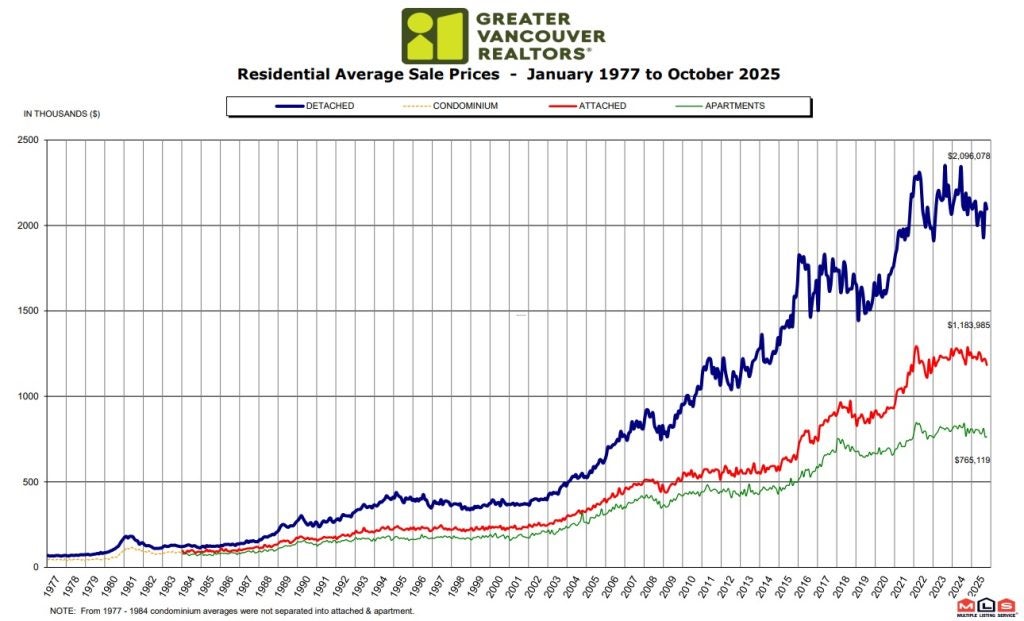

A Snapshot of Today’s Pricing Reality

To ground this in data:- Benchmark detached home price (Dec 2025): $1,879,800

- Down 5.3% year-over-year

The Bottom Line (No Spin)

This market rewards clarity, not confidence theatre.For buyers:

- You have time

- You have options

- You have negotiating power

- This is a rare low-competition window

- Pricing realism matters more than optimism

- Flexibility is currency

- Strategy beats hope

2026? That’s shaping up to be the year decisions finally get made. And the people who win won’t be the loudest — they’ll be the most prepared.